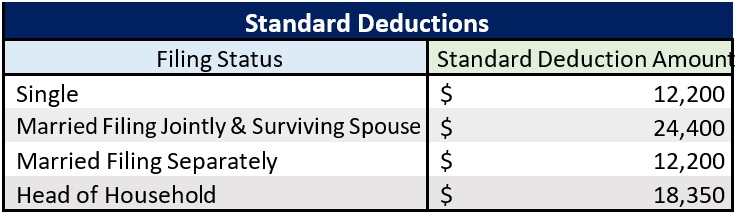

" In 2017, Some Tax Benefits Increase Slightly Due to Inflation Adjustments, Others Are Unchanged." " IRS Provides Tax Inflation Adjustments for Tax Year 2022."

" IRS Provides Tax Inflation Adjustments for Tax Year 2023." " Be Tax Ready-Understanding Tax Reform Changes Affecting Individuals and Families." " How Did the TCJA Change the Standard Deduction and Itemized Deductions?" “ Preliminary Details and Analysis of the Tax Cuts and Jobs Act.” " H.R.1 - An Act To Provide for Reconciliation Pursuant to Titles II and V of the Concurrent Resolution on the Budget for Fiscal Year 2018." This change was set to expire at the end of 2019, but the Further Consolidated Appropriations Act of 2020 resurrected it.Ĭ.

#IRSS STANDARD DEDUCTION 2017 PROFESSIONAL#

Journal Gift Subscriptions Strengthen Your Professional Relationships Send a message to your profess i onal peers and contacts that you apprec i ate the i r i mpact on your pract i ce - g i ve them a g i ft subscr i pt i on to the Journal.

(45) Elise Lin et al., “Trust Primer,” IRS.gov accessed August 1, 2017, at. Goetting and Joel Schumacher, “Gifting: A Prop-erty Transfer Tool of Estate Planning,”, January 2017 accessed July 31, 2017, at: publications/familyfinancialmanagement/mt199105hr.pdf.

(43) “Comparison of the Arm’s Length Standard with Other Valu-ation Approaches-Inbound,” IRS.gov, Augaccessed July 30, 2017, at: isi_c_06_04.pdf. (37) “Valuation Discounts, Transfers of Interests in Family-Con-trolled Entities for Transfer Tax Purposes,”, Augaccessed November 1, 2017, at: home/insights/2016/08/tnf-valuation-discounts-interests-family-controlled-entities.html.

#IRSS STANDARD DEDUCTION 2017 UPDATE#

Reardon, “Family Limited Partnership Update and Planning Thoughts,” Journal of Financial Service Professionals 64, No. (34) See Limited Partnerships-LP (2017), endnote 32. (32) “Limited Partnerships-LP,” accessed August 5, 2017, at. Grimaldi et al., “Legal, Tax, and Financial Issues for Working Minor Children,” CPA Journal (2017): 65–67. 16-55, endnote 6, for the $6,350 standard deduction amount. Income-Sh i ft i ng Strateg i es for Those w i th Ch i ldren Dan i el C.

0 kommentar(er)

0 kommentar(er)